You have to also have a credit score of no less than three hundred. It'd approve you In case you have no credit, but you'll want to be attending (or have graduated from) an accredited school. In the case of no credit, You will need to be Doing work toward an affiliate’s diploma (or have a person currently).

Though many dependable lenders gained’t give you a private loan if you have a credit rating of 550 or reduce, there are other strategies you might be eligible to get a loan.

Accessibility: Lenders are rated larger if their private loans are available to more people and require much less ailments. This may include things like decreased credit needs, broader geographic availability, quicker funding and simpler plus more transparent prequalification and software processes.

If you can’t get authorised for a poor-credit auto loan, or the rates are as well substantial, your best alternative could possibly be to delay buying a vehicle If you're able to. Use this the perfect time to improve your credit, pay out down other debts and preserve extra money to get a motor vehicle loan down payment.

Additionally, some customers have described troubles in achieving customer support Reps, which can be annoying for borrowers who need to have instant assistance.

Whilst it might appear to be shady that Nesmetaju, LLC will be the active entity driving the networks above, it isn’t unheard of to come across precisely the same corporation at the rear of a number of loan matching platforms.

Apply for a secured loan: When you aren’t able to find a co-borrower, implementing for just a secured loan is another route you might take. For these sorts of loans, you’ll have to provide up collateral — like a auto or banking account — to boost your creditworthiness. Should you default with a secured loan, nevertheless, your lender can legally seize your collateral.

Although some trusted lenders might call for you shell out an application charge or perhaps a credit report payment, these are typically taken out from the loan you borrowed.

Though unsecured private loans are not normally The most affordable alternative, they are the safest, no less than through the borrower's perspective. Such as, using an vehicle title loan, you transfer ownership of your auto on the lender until finally the loan is repaid.

Aside from Assembly Upstart’s minimum amount credit rating specifications, likely borrowers will also have to fulfill the following requirements:

Our editors are dedicated to bringing you impartial scores and knowledge. Our editorial content just isn't affected by advertisers.

Late payment: If you miss a payment, a lender may possibly charge a flat price or maybe a share within your skipped payment.

LendingClub is often a peer-to-peer lending marketplace in which you can borrow around $40,000. You may also transform your because of day with LendingClub, but make sure you check how changing your payment deadlines could impact your interest charges.

Payment-to-cash flow ratio. This is an additional measurement of no matter whether you can afford a car payment, moreover car or truck insurance plan. Your PTI ratio is calculated by incorporating your estimated car loan and automobile insurance coverage payments, and more info dividing that total by your gross regular profits. Preferably, it should be less than 20%.

Luke Perry Then & Now!

Luke Perry Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Joshua Jackson Then & Now!

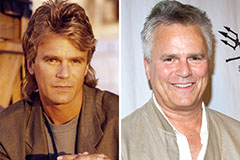

Joshua Jackson Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!